Introducing MarMoFin

The Passionate Investor's

Platform.

Discovery. Relative Strength. Multi-timeframe charts.

Every tool you need, in one coherent workspace.

Introducing MarMoFin

Discovery. Relative Strength. Multi-timeframe charts.

Every tool you need, in one coherent workspace.

Everything in one place

MarMoFin brings together the tools serious investors rely on — unified into one seamless workflow.

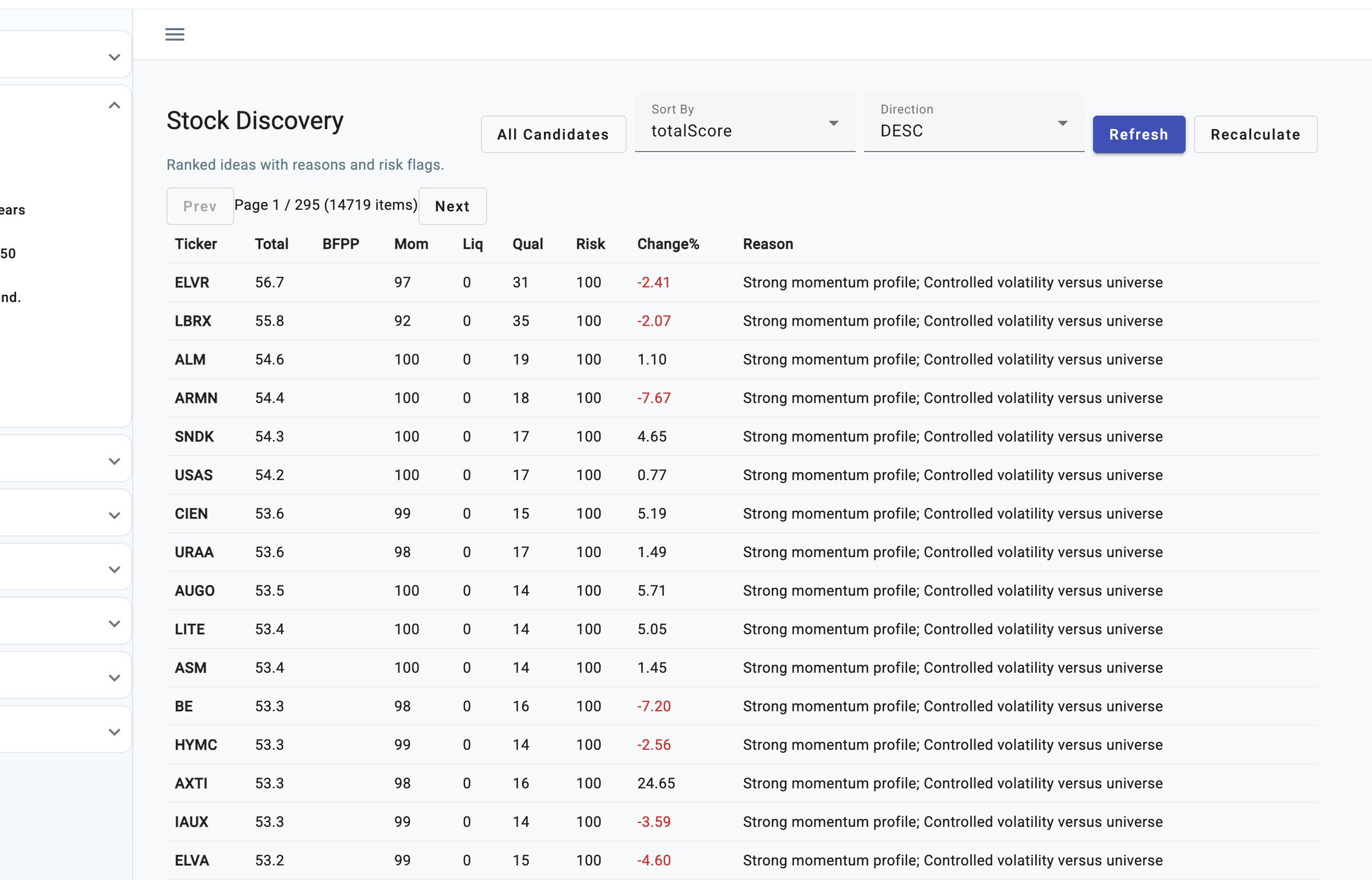

AI-ranked candidates scored by momentum, liquidity, and pattern quality. Stop searching — start reviewing.

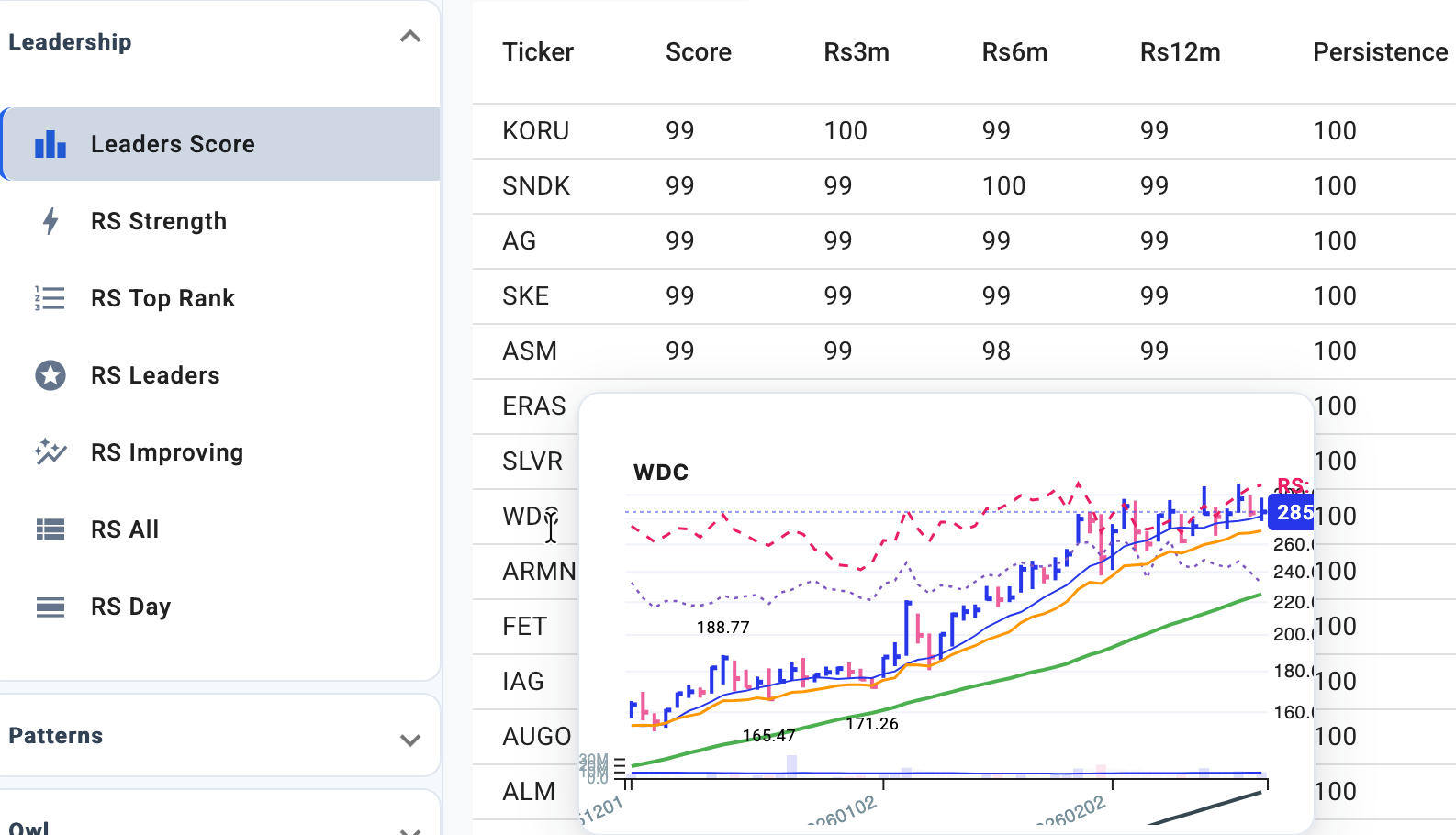

Rank every stock by 3M, 6M, and 12M leadership. Find who's winning — and who's starting to.

Composite scoring model that merges strength, momentum, and quality into a single sortable rank.

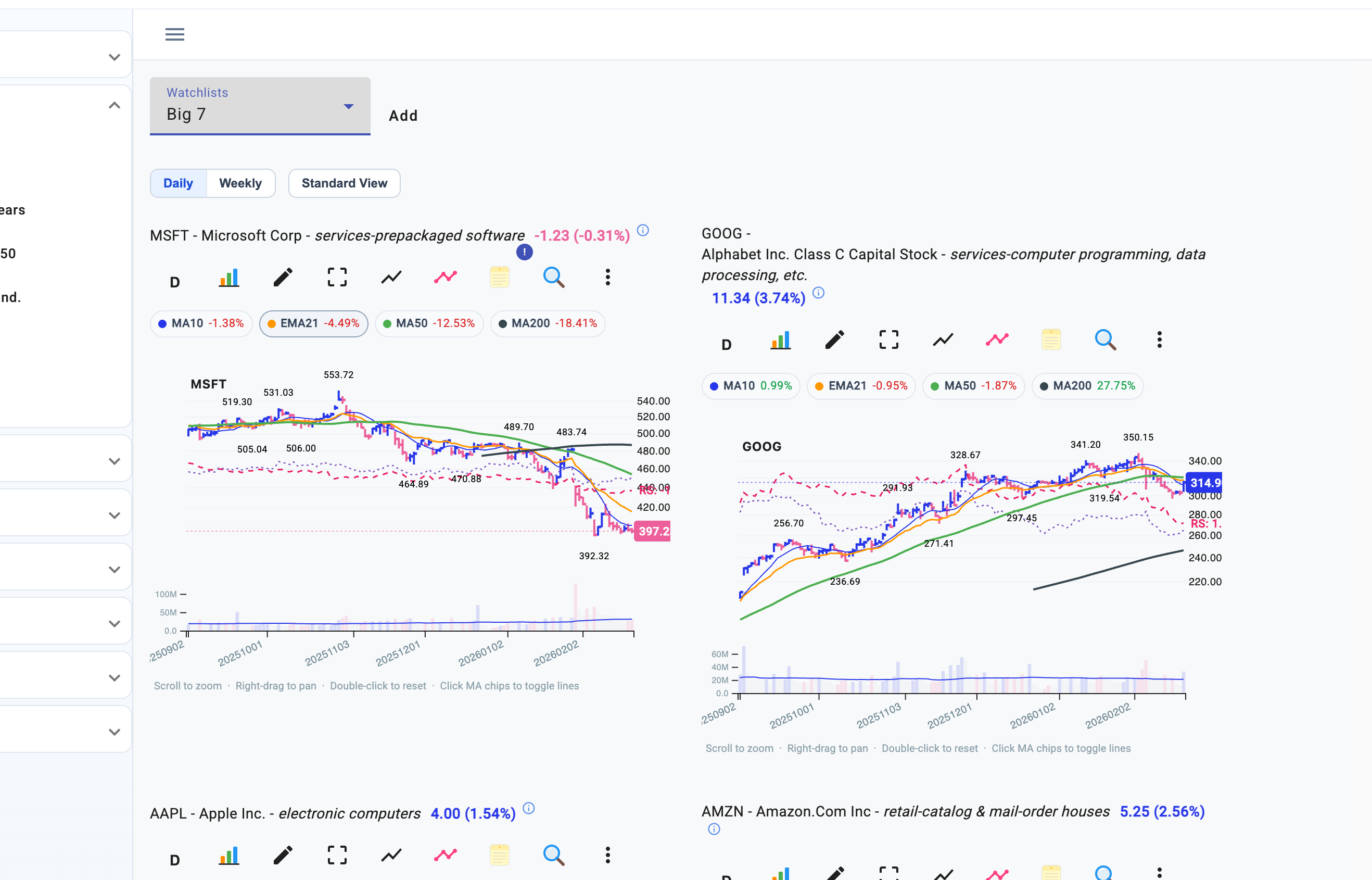

Compare your watchlist side-by-side. Daily, weekly, with RS overlays. One view, many decisions.

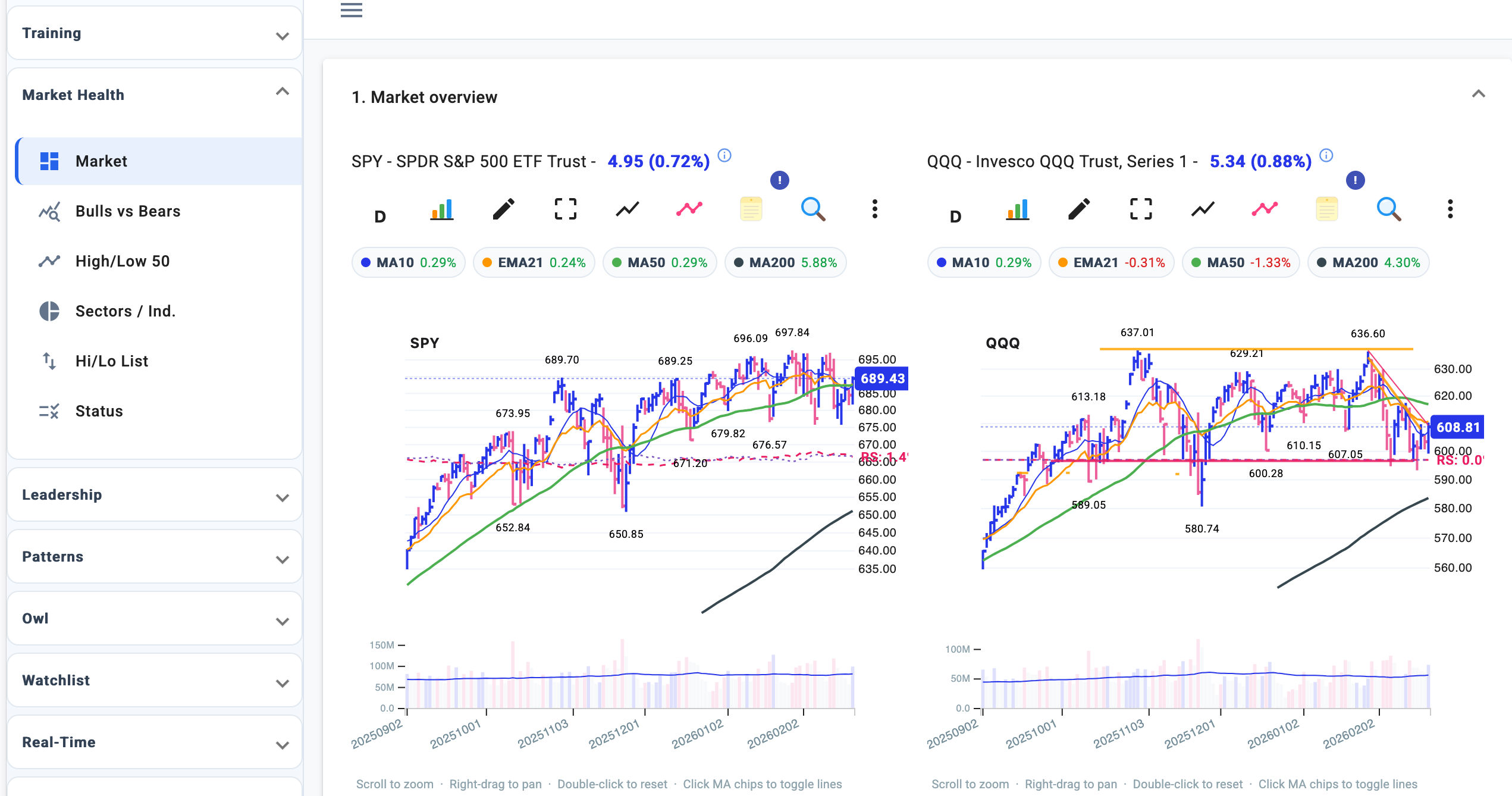

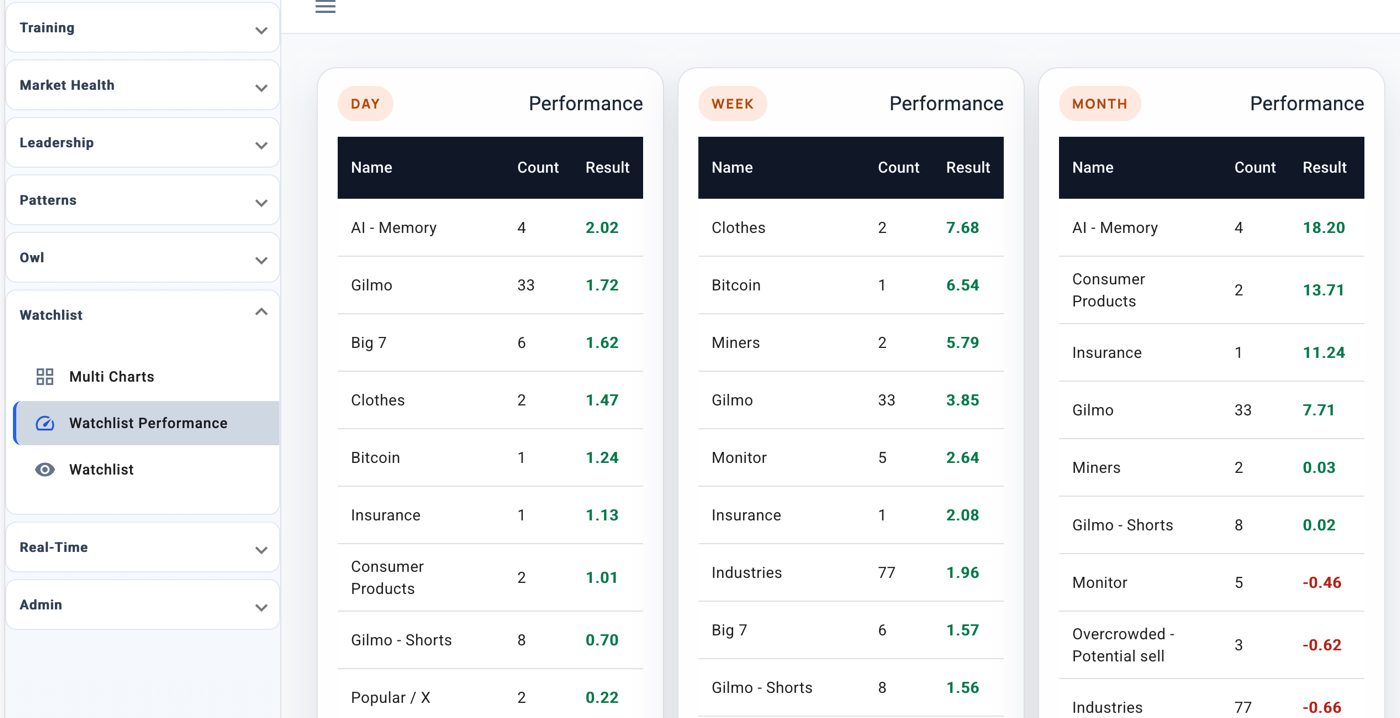

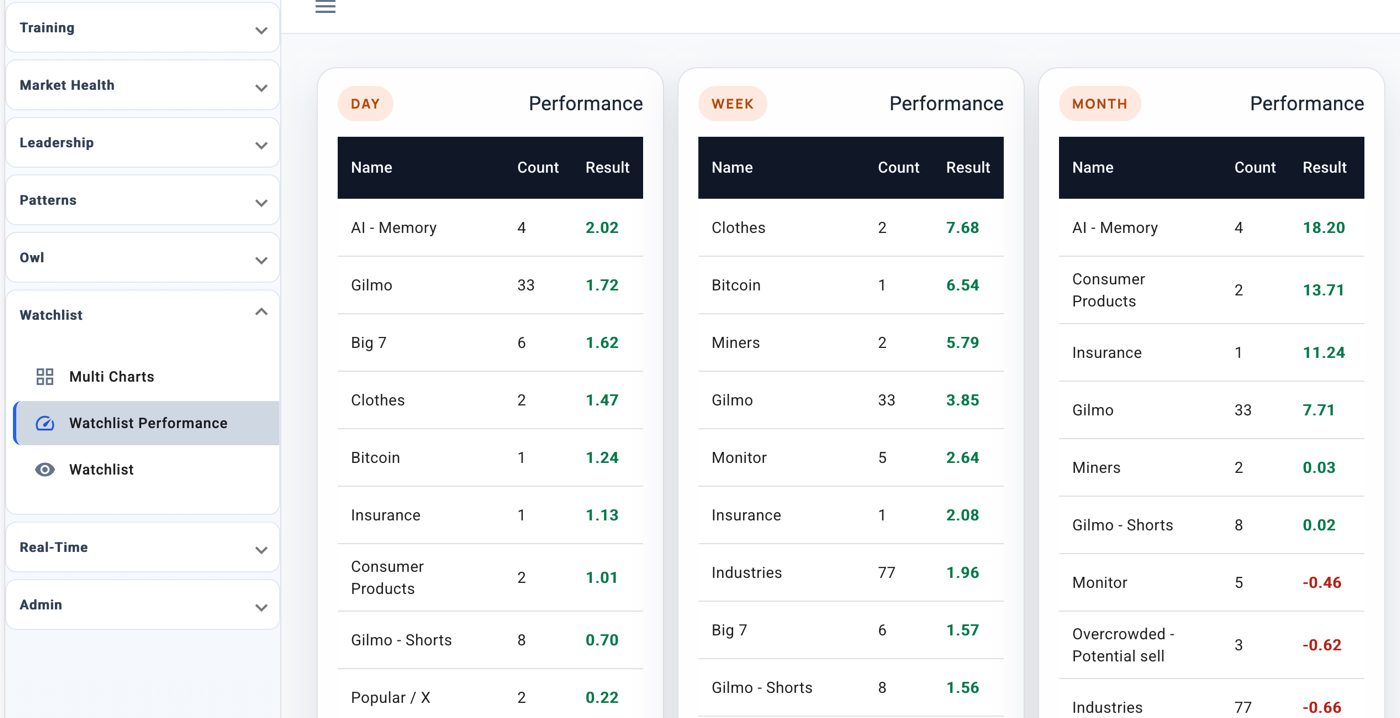

Measure which watchlists actually produce winners. Close the loop between idea and outcome. Track signal quality over time and iterate your edge.

Cup & Handle, Wyckoff, Pocket Pivots, and more — automatically detected across the full market.

Feature 01

The Discovery Scanner ranks thousands of stocks by momentum, liquidity, and pattern quality — presenting only the candidates worth your time.

Feature 02

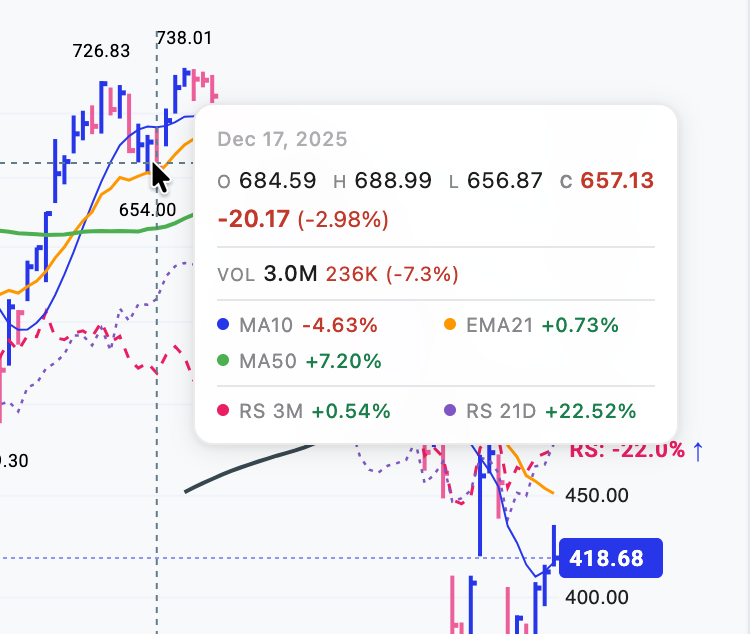

The Stock Detail view gives you 6-month candlestick chart, RS scores, composite ranking, EPS date, SEC 10-Q link, and recent price history — all on one screen.

Feature 03

Relative Strength ranking across 3M, 6M, and 12M timeframes gives you a mathematically precise view of market leadership — updated daily.

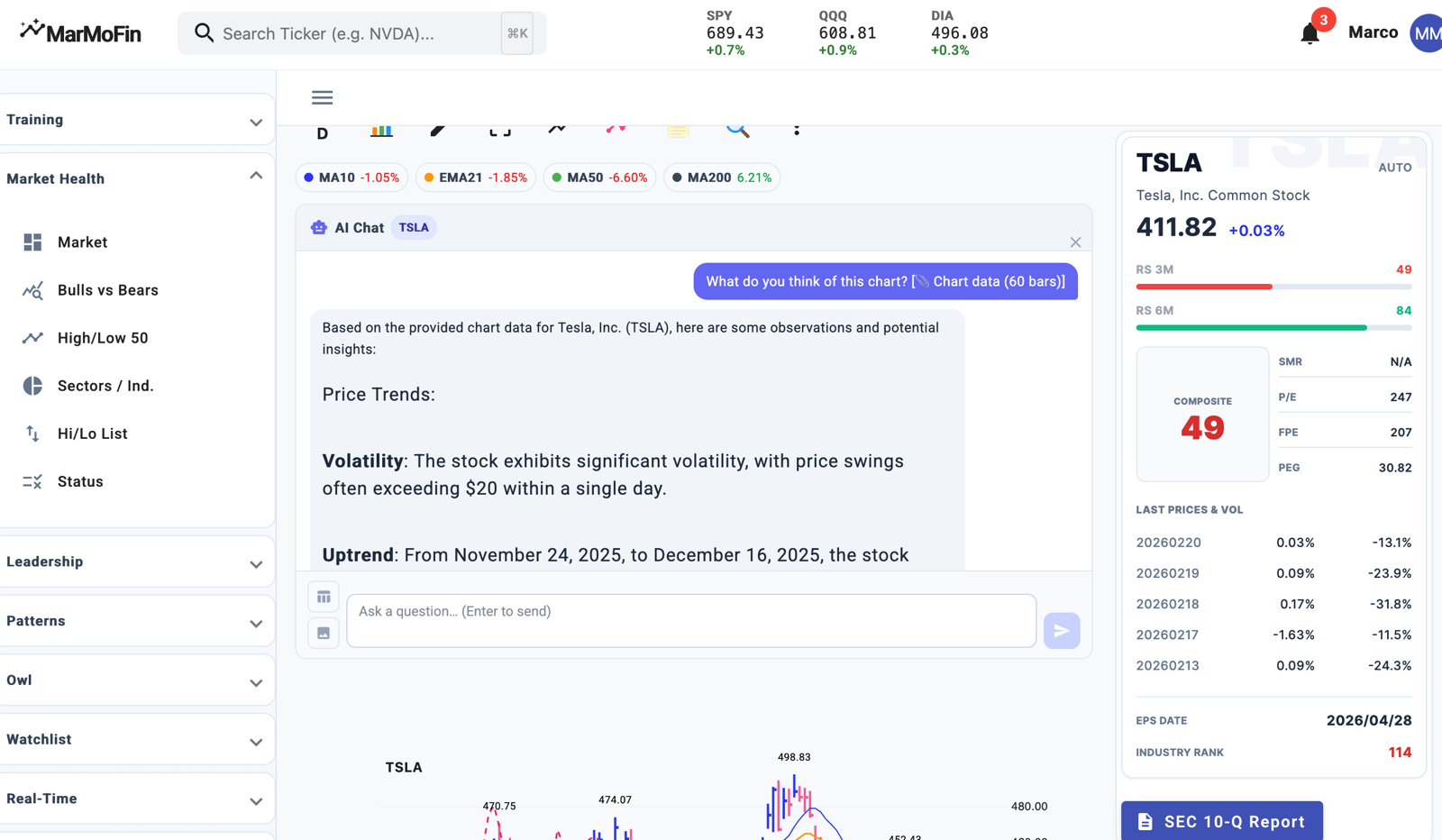

Embedded AI Intelligence

MarMoFin embeds AI directly into the research workflow — not as a separate tab, but as a co-analyst inside every chart. Ask questions, get quarterly report breakdowns, and surface insights from earnings calls. Runs locally with Ollama or in the cloud via Azure AI Foundry.

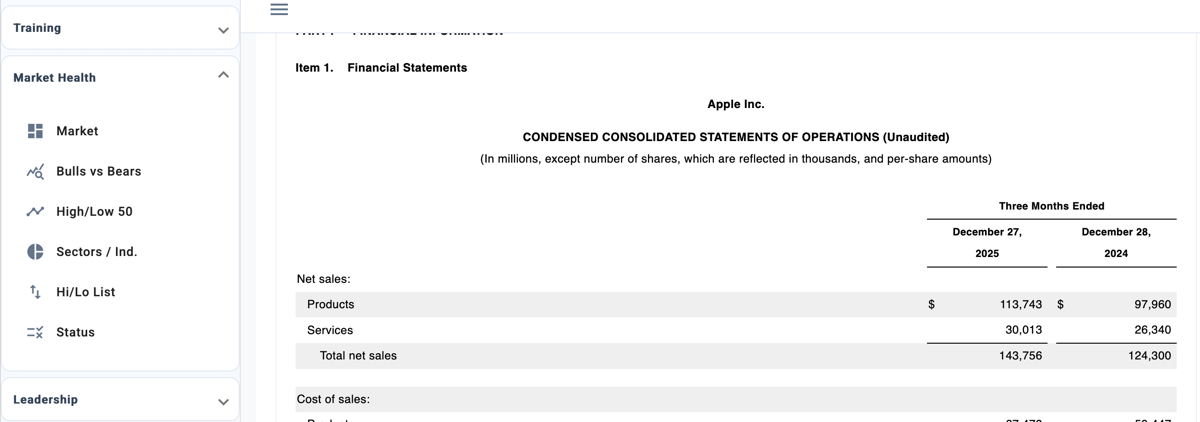

One click downloads the latest 10-Q from SEC EDGAR, extracts structured XBRL financial data, and asks the AI to produce a 8-section analyst brief — revenue trend, margins, cash flow, balance sheet, risks, and verdict.

Ask the AI to analyse any stock directly from the chart menu. The model receives company description, sector, and any previously stored 10-Q analysis as context before responding.

Ask free-form questions about earnings call transcripts, financials, or market context for any ticker — directly inside the chart. The AI has access to all stored research for that ticker.

app.ai.provider=foundry.

Professional Chart Drawing

Six precision tools built directly into every chart. Draw trend lines, channels, and annotations — all auto-saved to the server.

Draw diagonal support and resistance lines anchored to exact price-date intersections. Extends across the full visible range.

Lock a price level horizontally across the chart. Perfect for marking key support, resistance, and pivot points.

Draw one line — the second parallel rail appears automatically offset by 3%. Drag endpoints to refine the channel width.

Dashed line with a filled arrowhead. Point to specific candles, volume spikes, or pattern breakout zones.

Click anywhere on the chart, type your note, press Enter to place it. Live preview shows while you type.

Click and drag across any range to instantly see price change % and bar count expressed in both trading days and weeks.

Complete workflow

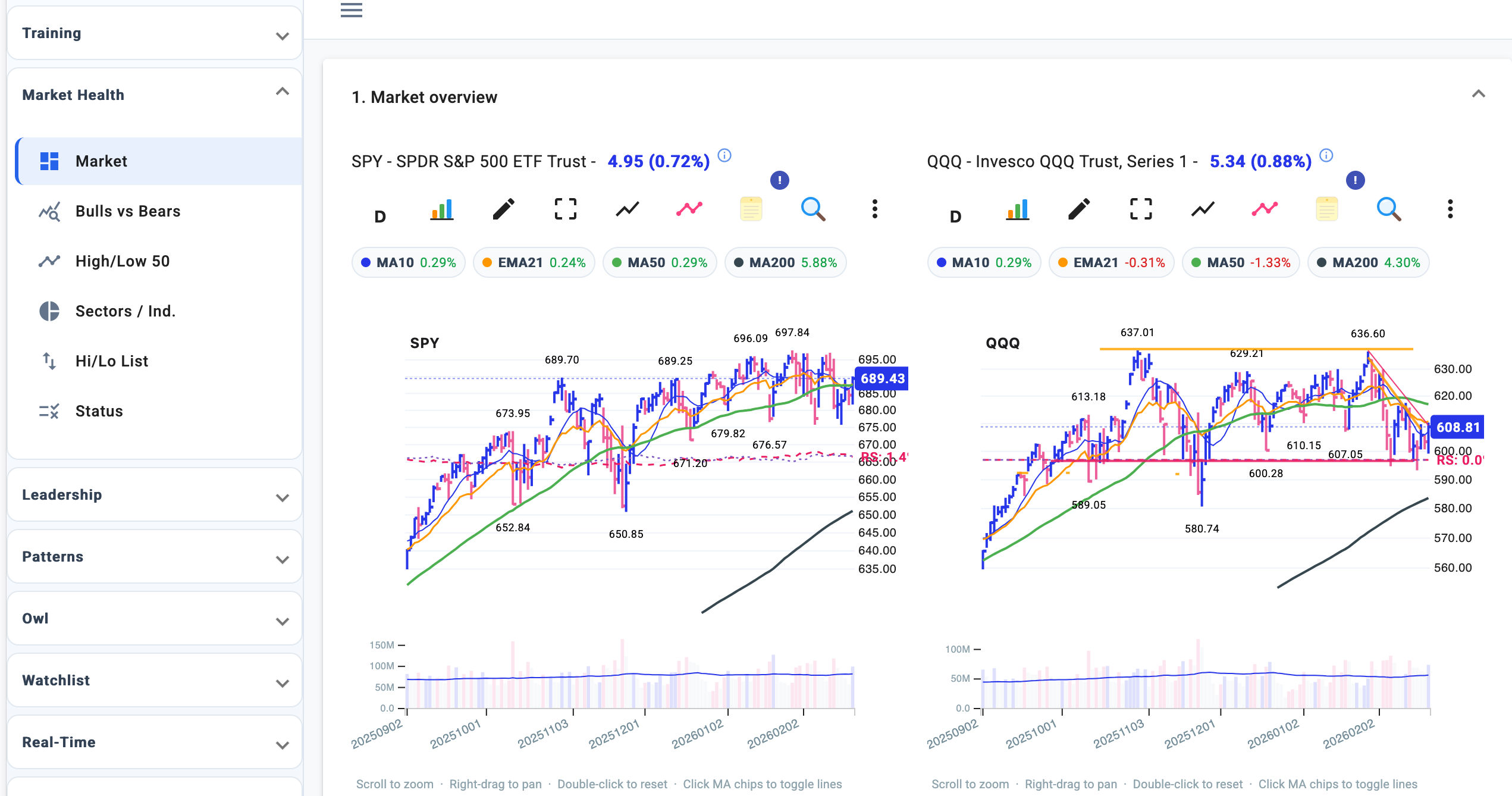

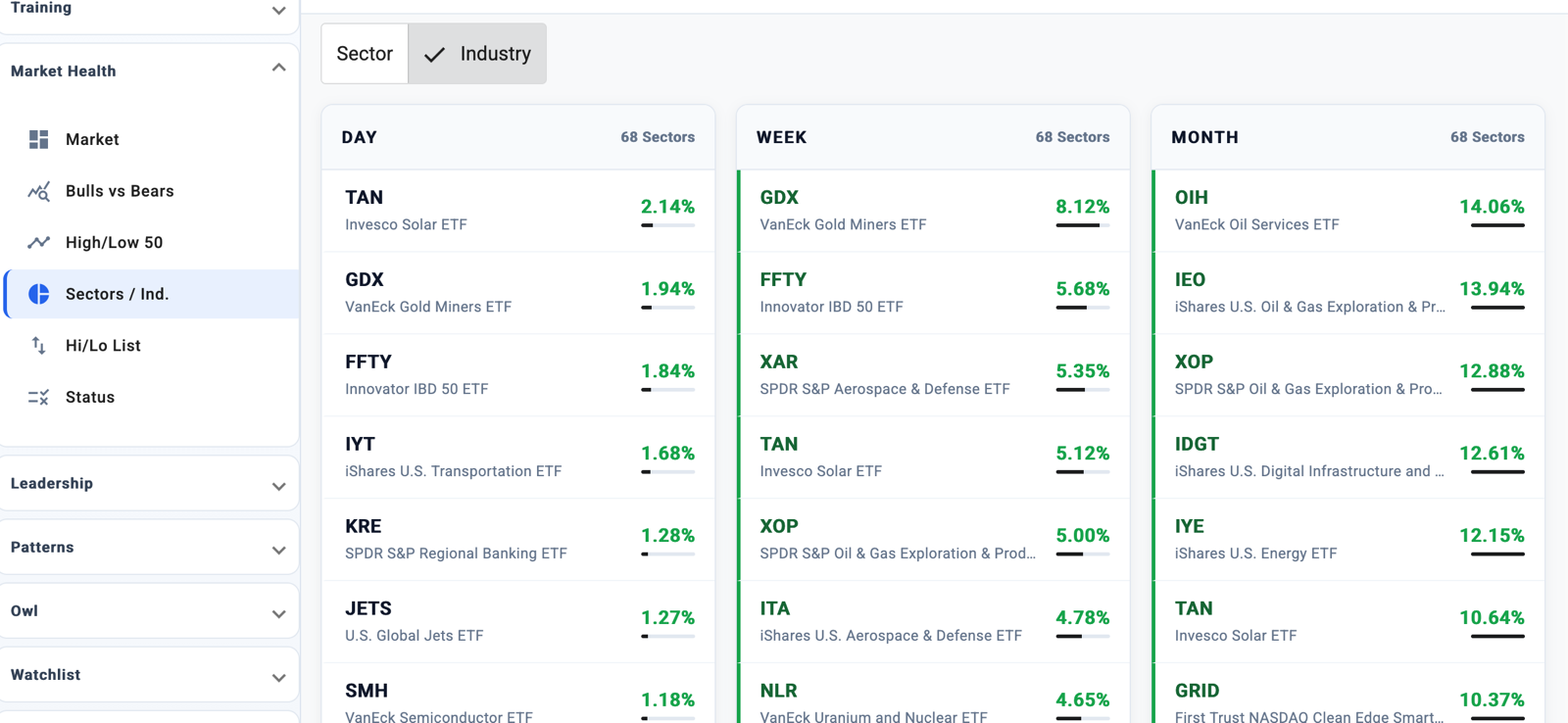

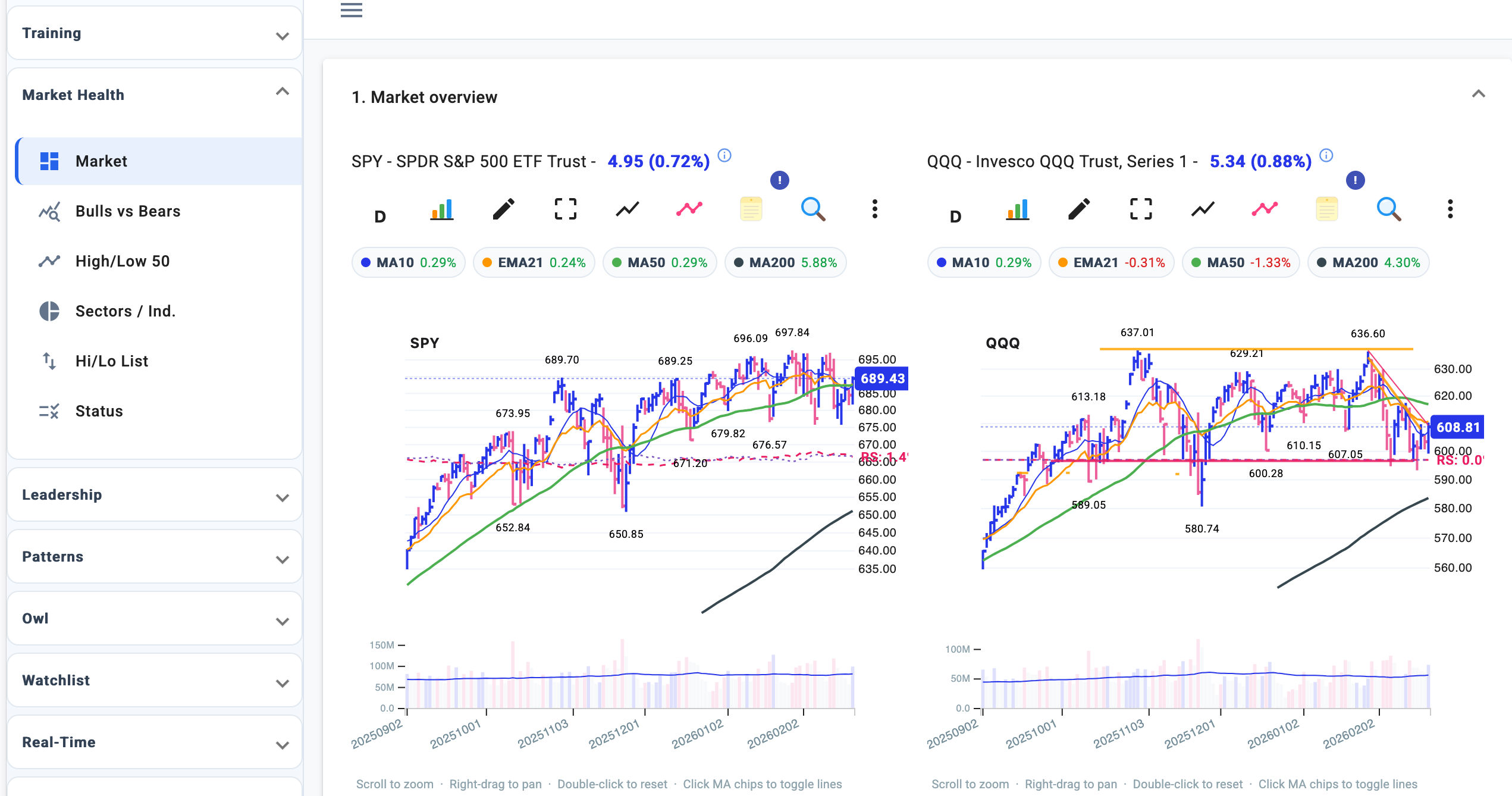

Check market health with Bulls/Bears, Sectors, and High/Low 50.

Run the Discovery Scanner to surface ranked opportunities.

Cross-check RS rank, technical pattern, and earnings dates.

Track performance and refine your selection criteria over time.

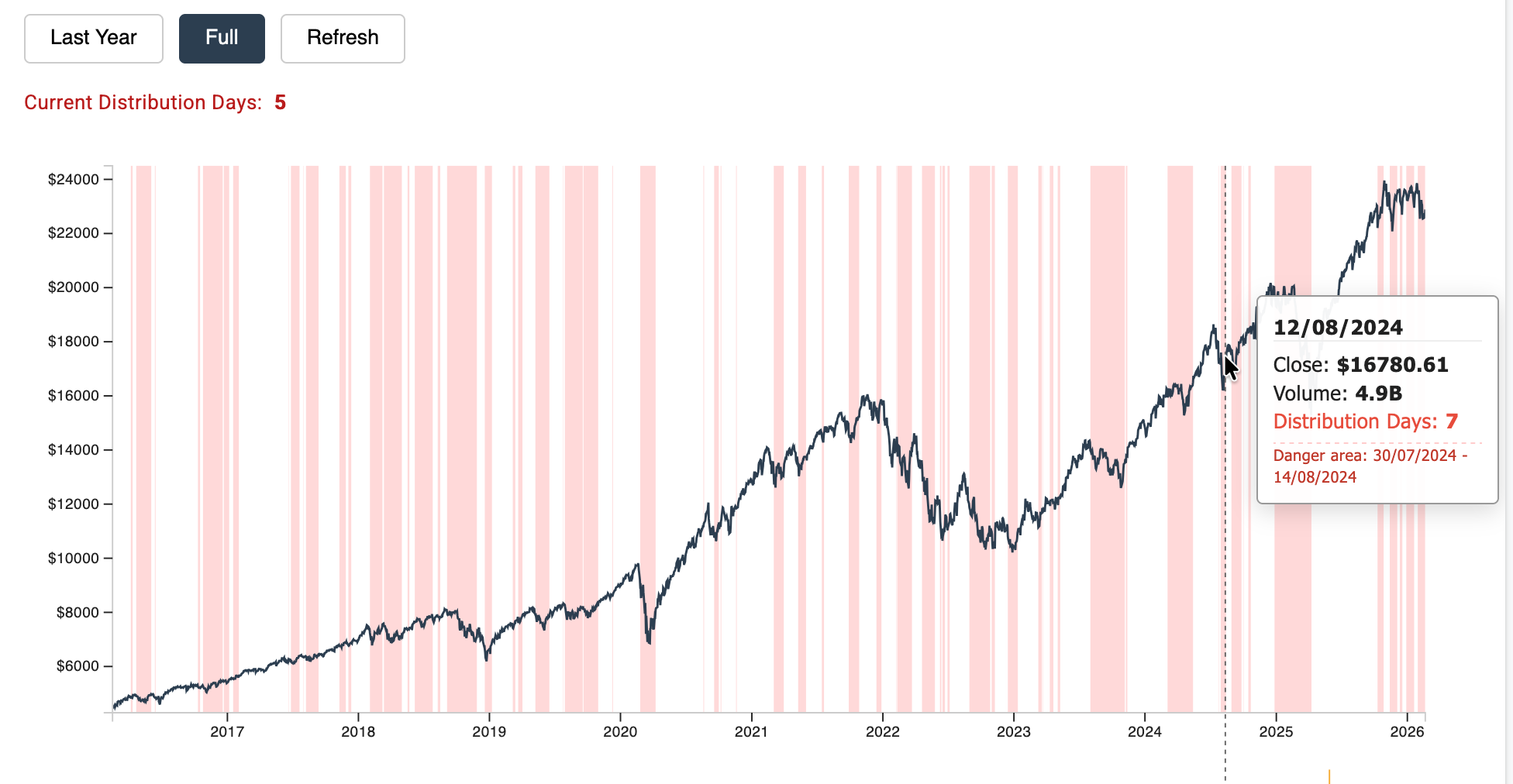

O'Neil Distribution Day Count

The distribution day count — a concept at the heart of O'Neil's How to Make Money in Stocks — tracks days when the Nasdaq closes lower on higher volume than the previous session. When the count reaches 5 or more within a rolling window, institutional selling is dominant and the risk profile changes materially.

MarMoFin tracks this count automatically, highlights danger zones directly on the Nasdaq price chart, and keeps the current number visible at a glance. Stay fully invested in raging bull markets; step back when the professionals are quietly exiting.

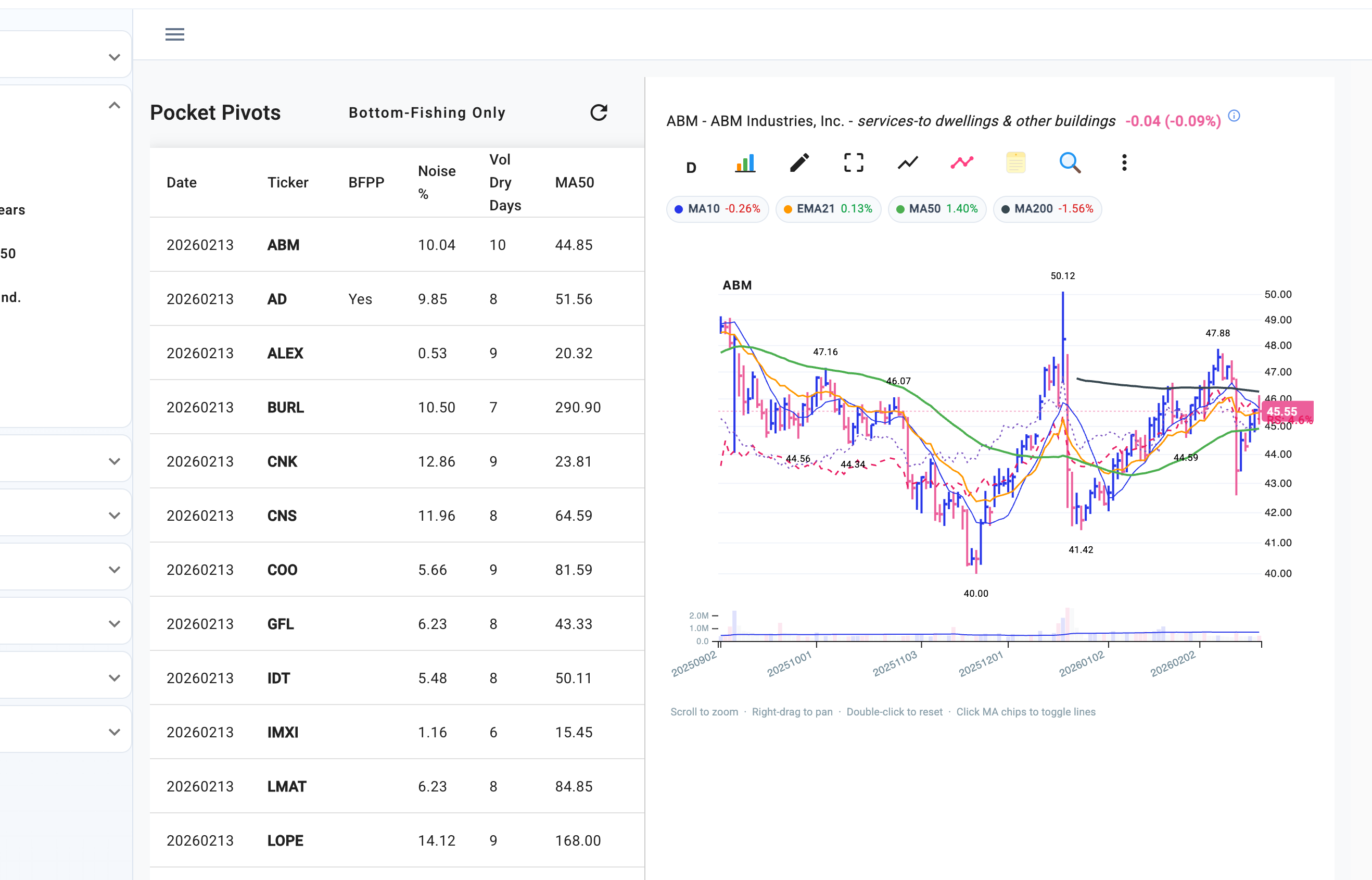

Technical Patterns

MarMoFin runs 11 pattern recognition engines across the full market — every day.

Pocket Pivots

The Pocket Pivot scanner identifies volume-driven entry signals before the stock breaks out. Each result shows the chart alongside noise %, volume dry days, and MA50.

Multi-Chart Workspace

Load any watchlist into the multi-chart view and scan every position in seconds. Toggle daily/weekly, compare RS overlays, and spot the strongest setups without switching pages.

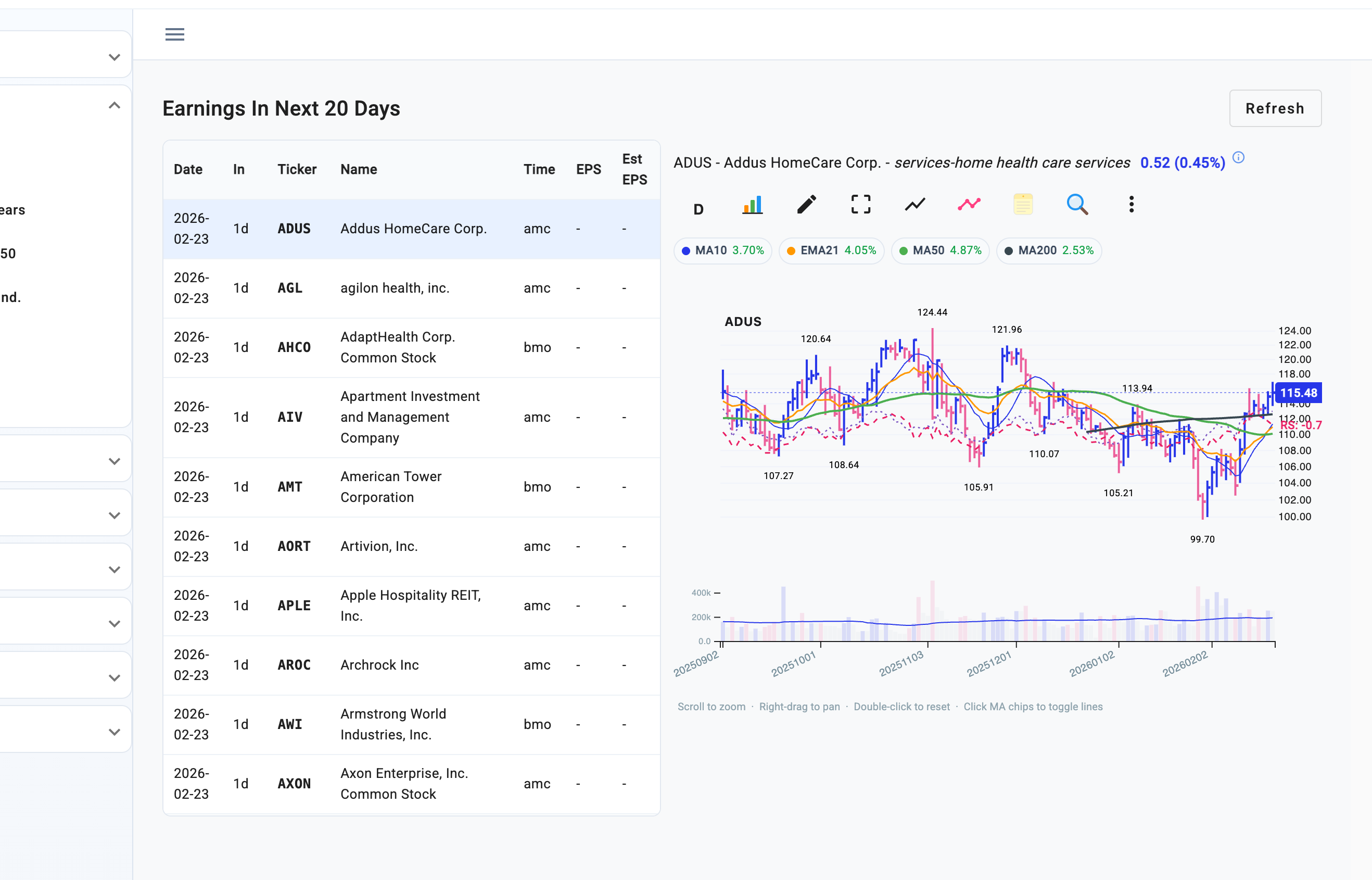

Earnings Intelligence

The Earnings Calendar integrates upcoming events directly into your setup evaluation — so you know the risk before you take the trade.

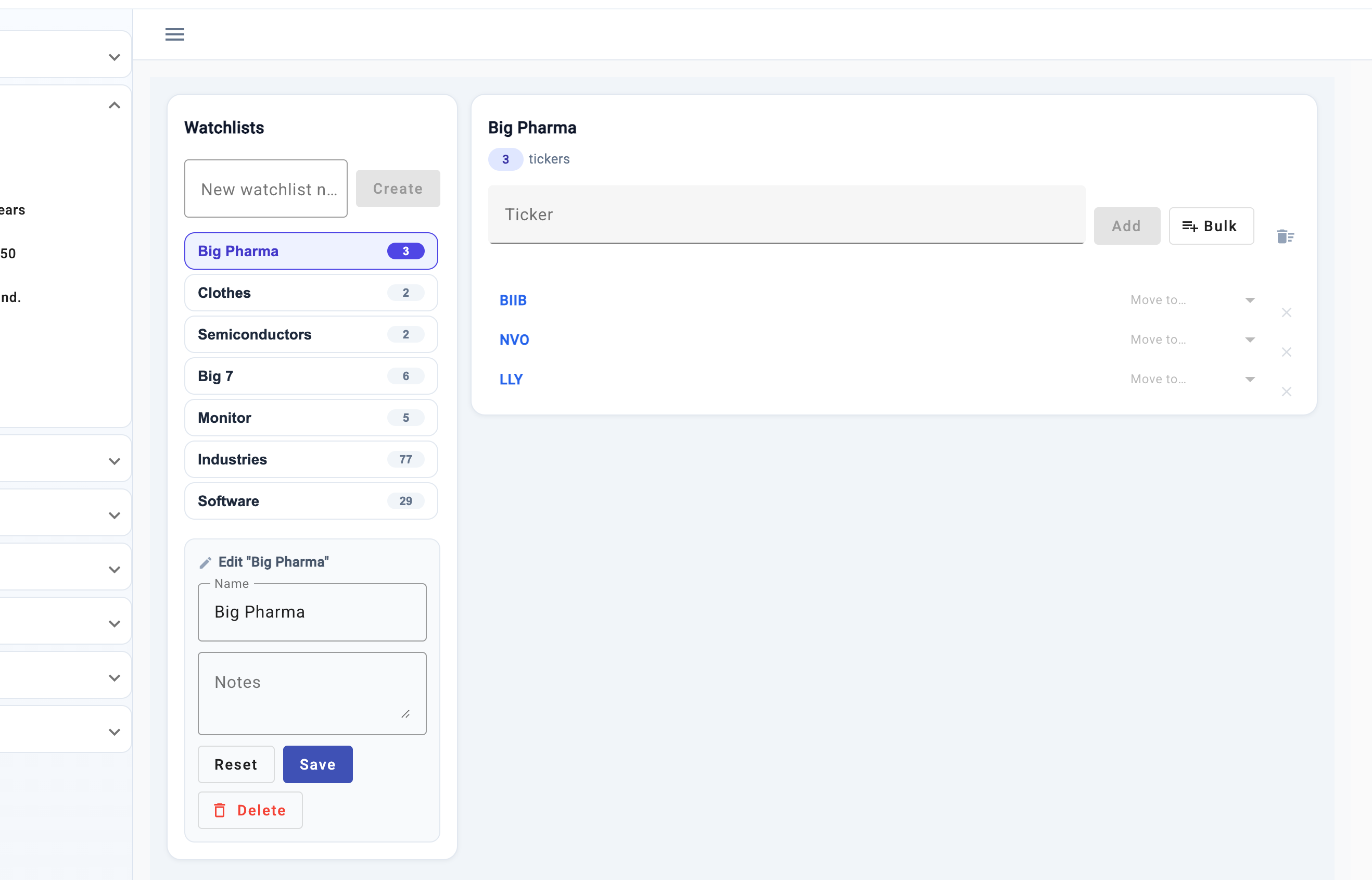

Watchlist Intelligence

Manage multiple watchlists with bulk import, real-time chart tooltips on hover, and performance scorecards that tell you which criteria actually work.

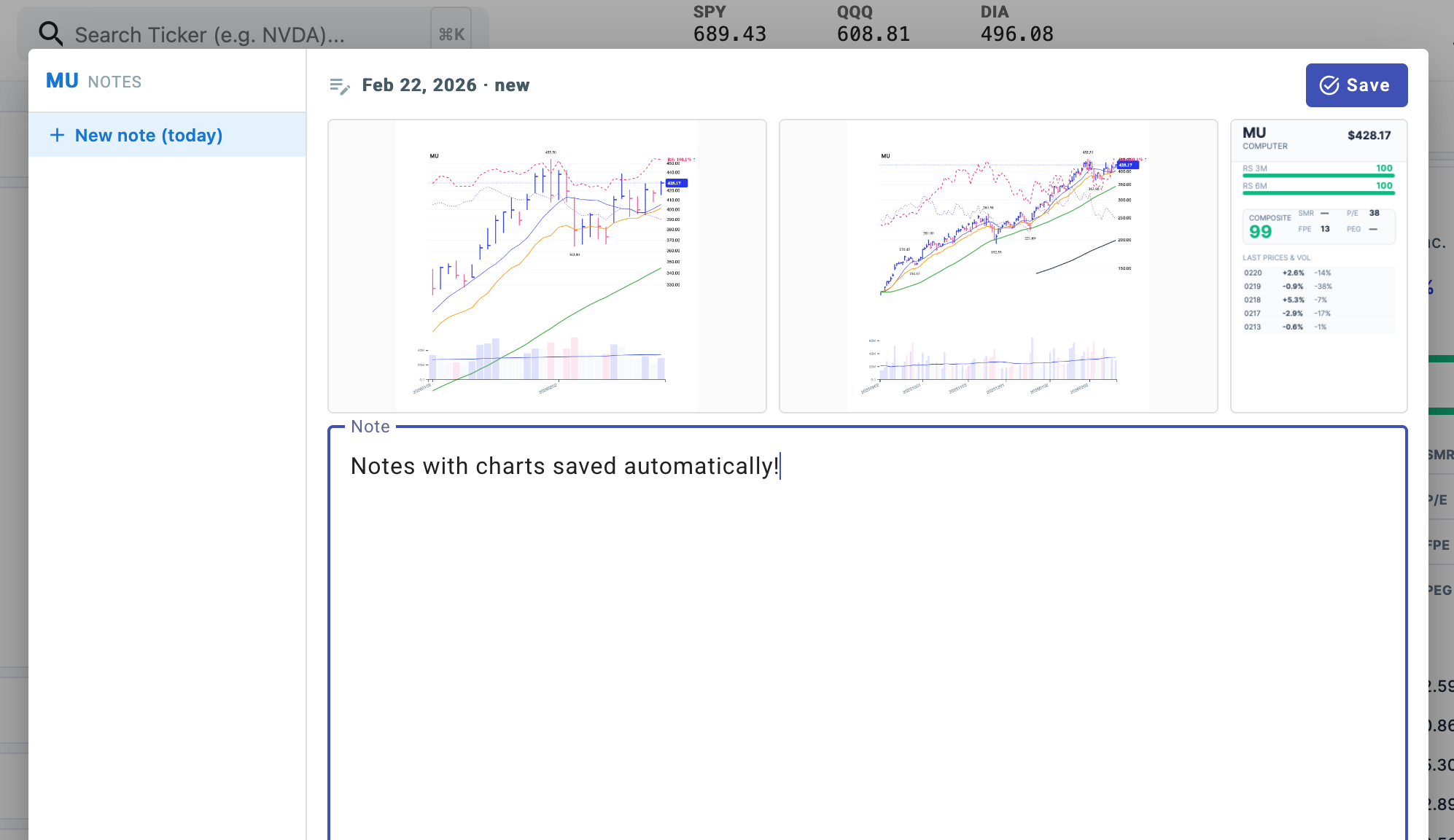

Trading Journal

Open the journal from any chart with a single click. A screenshot of the chart is captured automatically — exactly as it looks at that moment — and attached to your note. No manual export, no copy-paste.

Quarterly Documents & Filings

Access 10-Q filings, earnings call transcripts, and conference call notes without leaving the platform. Every document is linked directly to the ticker — one click from the chart to the source.

Daily Routine

MarMoFin opens with a structured daily routine — market health, breadth, sectors, and leadership in one view. Know the environment before you look at any individual stock.

Pattern Recognition Training

The Chart Game shows you real historical charts of US stocks — with the ticker hidden. Scroll through bar by bar, enter a long or short position, then see your P&L. Pattern recognition is a skill. This is the rep counter.

Standing on the shoulders of giants

MarMoFin distils three centuries of market mastery into a single, coherent workflow. Every screen, every signal, every ranking traces its lineage to one of three legends.

O'Neil proved that institutional sponsorship and earnings acceleration — not valuation — drive the biggest winning stocks. His CAN SLIM system, the Relative Strength Line, and the concept of the perfect base gave investors a repeatable, data-driven playbook.

Wyckoff mapped how the "Composite Man" (smart money) accumulates and distributes positions invisibly in plain sight — through price and volume footprints that retail most investors ignore. His six-phase market cycle remains the most precise roadmap for understanding where a stock stands in its life-cycle.

"The Great Bear of Wall Street" built and lost fortunes by reading the tape before charts existed. Livermore's core insight — that markets move in trends, that sitting still is the hardest discipline, and that cutting losses is non-negotiable — remains the iron foundation beneath every serious investor's edge.

"The market is never wrong — opinions often are." — Jesse Livermore

Under the hood

Modern, type-safe frontend with reactive state and Material Design components.

High-performance Java backend with virtual threads, JPA, and scheduled analytics pipelines.

Live market data streaming with instant UI updates — no polling, no stale numbers.

Reliable relational data store powered by a professional technical analysis library.

Polygon, Yahoo Finance, FMP, and Nasdaq feeds — validated, normalized, and stored daily.

11 automated pattern engines score and rank setups across thousands of tickers nightly.